Create a personalized financial planning report using similar inputs to that of the Tax-Free Retirement Calculator, and gather insights such as:

• A snapshot of your current finances

• A deep dive of your living expenses

• A tax-free retirement scenario and financial outlook

• Practical and implementation specific recommendations

• Financial planning checklist

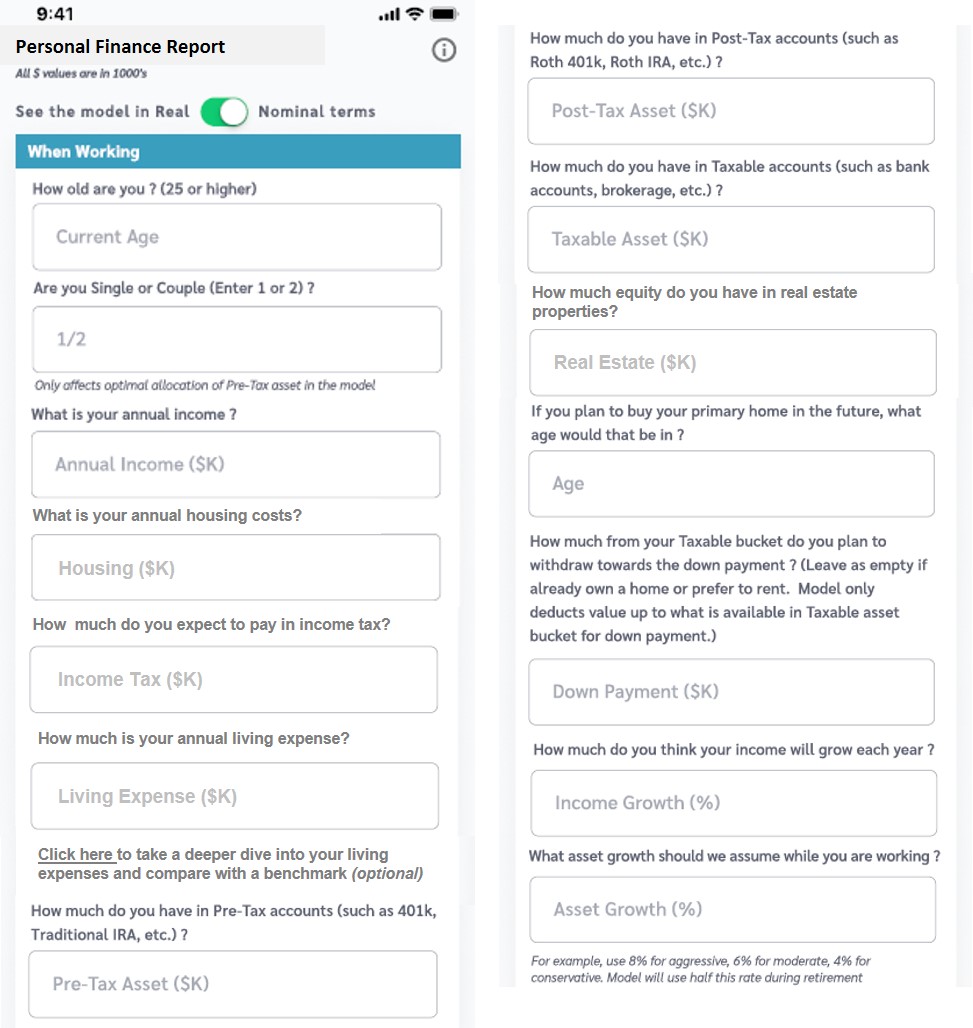

You can generate an on-demand Personal Finance Report (PFR) using the FinCrafters app. Your PFR is processed using information similar to what you provide to the Tax-Free Retirement Calculator, such as: your current income, expenses and the value of your existing assets divvied up by tax buckets. The article “Tax Treatment of Investment and Retirement Accounts” talks about the various tax buckets available for savings.

You can specify your future down payment needs for buying a house and the assets you want to leave behind as legacy. The model can be run with dollar values in either real terms (present value) or nominal terms (future value). Refer to “What Does Inflation-Adjusted Means?” for an explanation of these terms.

You can set your expected growth rates for income, market return and inflation. Refer to “Asset Growth Using Rule of 72” to understand how to pick growth rates. For example, income growing at 3.6% CAGR would double in 20 years, and asset value growing at 7% CAGR would double every decade. The S&P 500 has historically returned 10% CAGR (including dividends) over the past half century (see “S&P 500 Performance in the Last 50 Years” for more details). Hence, an assumption of a 7% market growth rate is in between moderate and aggressive.

Using the information you provided, we first review your financial standing and present details about your annual cash flow and asset diversification by tax buckets.

We then compare your living expenses against a benchmark and break it down by categories (utilities, car, etc.) and sub-categories (internet, gas, etc.).

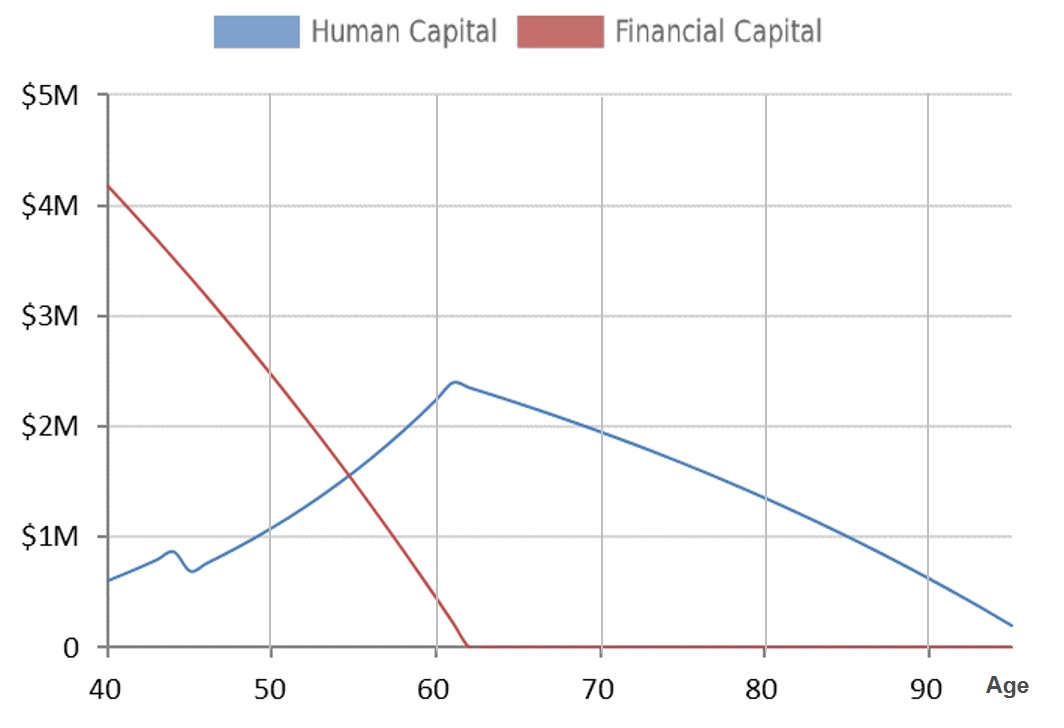

Next section focuses on crafting a tax-free retirement scenario, starting with a chart of your human and financial capital. Human capital is your lifetime earning potential. It declines with age and reaches 0 when you retire. Financial capital is your investible asset or nest egg. You can find more information about this topic in “Human vs. Financial Capital.”

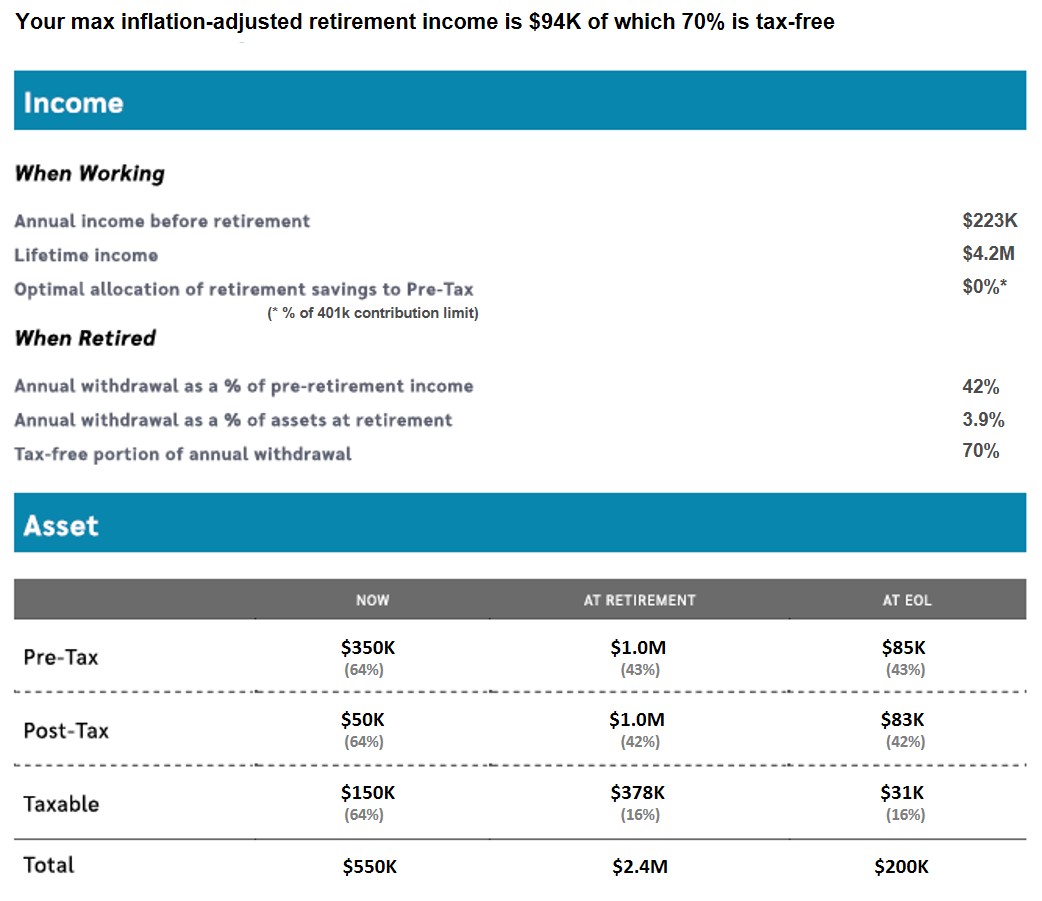

The engine optimizes how much of your retirement savings needs to go into Pre-Tax (e.g., 401k, traditional IRA) vs. Post-Tax (e.g., Roth 401k, Roth IRA) in order to maximize tax-free income. It then calculates the maximum retirement income that will sustain your nest egg through your life expectancy, while leaving behind only the specified legacy amount. It reports how much of your retirement income will be tax-free. A detailed breakdown of assets by tax buckets at critical junctures in your life are also tabled out.

A detailed financial projection of your income, savings, assets and retirement income by tax buckets is reported.

We summarize the findings with implementable recommendations to further optimize your tax buckets so you can chart your course toward a tax-free retirement!

Make an appointment with a FinCrafters expert to review your report.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com