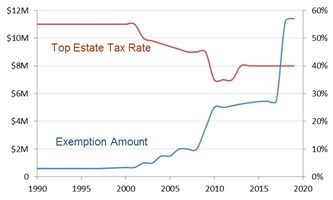

The current estate tax rate and exemption amounts have been very favorable when viewed in their historic context.

Estates worth more than the exemption amount are subject to an estate tax before it passes on to its beneficiaries. The Federal estate tax rate is at a historically low point at 40% and the lifetime exemption amount is at an all-time high of $11.4M / $22.8M for individuals / couples. However, the TCJA enacted changes will revert to the 2017 levels (half of the current exemptions) unless Congress renews the provisions by 2025. Currently, fifteen States and Washington D.C. also have an estate tax, and six States have an inheritance tax.

The passing of the estate to a spouse is not taxable. It is important to transfer the unused exemption amount to the surviving spouse by filing for an estate tax return. Doing so will increase the surviving spouse’s own individual exemption by this unused amount.

The passing of the estate when the giver is alive is considered a gift (and as inheritance when passed after death). Gifts greater than an exclusion amount are counted towards the giver’s lifetime exemption for estate taxes. The 2019 exclusion amount is $15K / $30K per recipient per year if the giver is an individual / couple. Cash gifts from a foreigner to a U.S. person are not taxed in the U.S., but any such gifts >$100K will need to be reported in tax filings.

The estate or giver is always response for paying taxes and not the beneficiaries or receiver. The basic principles of an Estate Trust are explained in our blog “What is an Estate Trust?” Estate planning involves elaborate use of more complex Estate Trusts to reduce estate tax for high-net-worth individuals. Two such trusts are discussed in ours blogs “Irrevocable Life Insurance Trust (ILIT)” and “Charitable Remainder Trust (CRT).”

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com