Using an advanced Tax-Free Retirement Calculator, we show how to implement a tax-optimized savings plan that will achieve ≈0% tax at retirement.

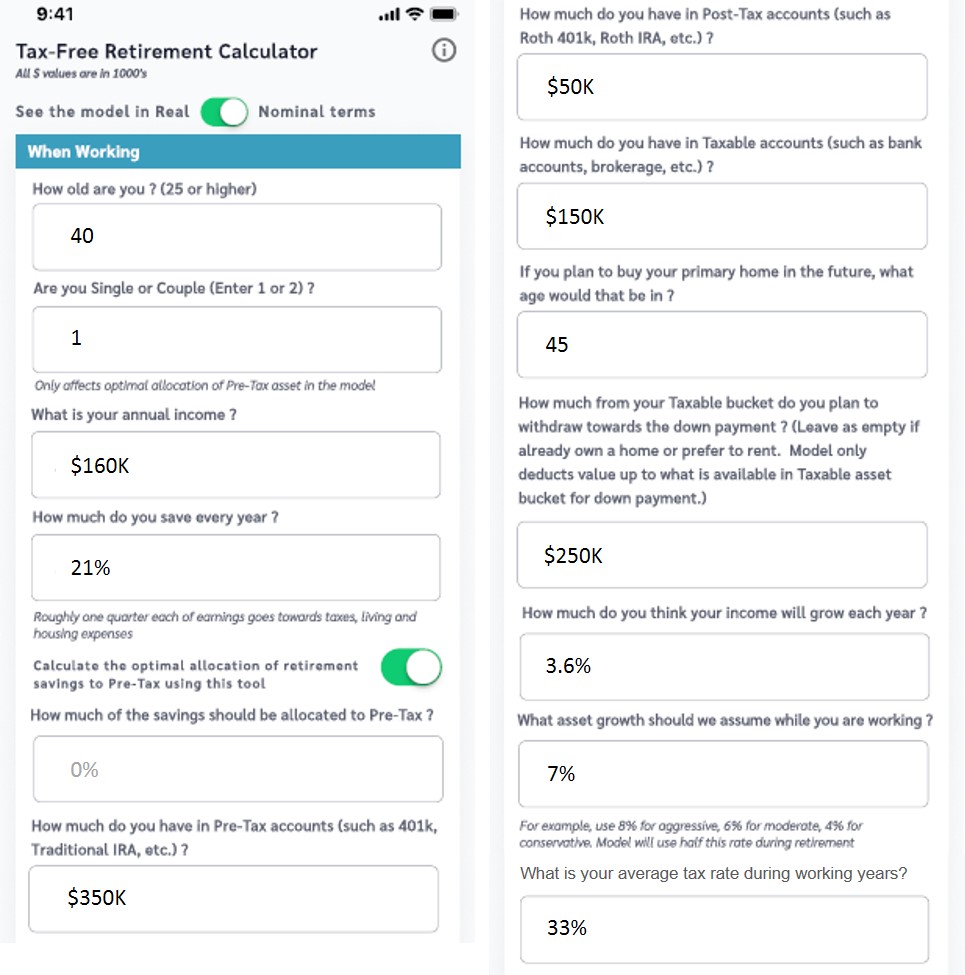

First, let us look at the Tax-Free Retirement Calculator from FinCrafters App. It is a more advanced version of the Retirement Planning Calculator discussed in “Retirement Scenarios.” It enables you to figure out how much to allocate between your Pre-Tax (e.g., 401k, traditional IRA) and Post-Tax (e.g., Roth 401k, Roth IRA) retirement accounts during your working life, and also to estimate what your potential retirement income is and what portion of it is tax-free.

The model can return dollar values in either real terms (present value) or nominal terms (future value). Refer to “What Does Inflation-Adjusted Means?” for an explanation of these terms. You specify your current assets divvied up by tax buckets. The article “Tax Treatment of Investment and Retirement Accounts” talks about the various tax buckets available for savings. You can also specify your future down payment needs for buying a house and the assets you want to leave behind as legacy.

Refer to “Asset Growth Using Rule of 72” to understand how to pick growth rates. For example, income growing at 3.6% CAGR would double in 20 years, and asset value growing at 7% CAGR would double every decade. The S&P 500 has historically returned 10% CAGR (including dividends) over the past half century (see “S&P 500 Performance in the Last 50 Years” for more details). Hence, an assumption of a 7% market growth rate is in between moderate and aggressive.

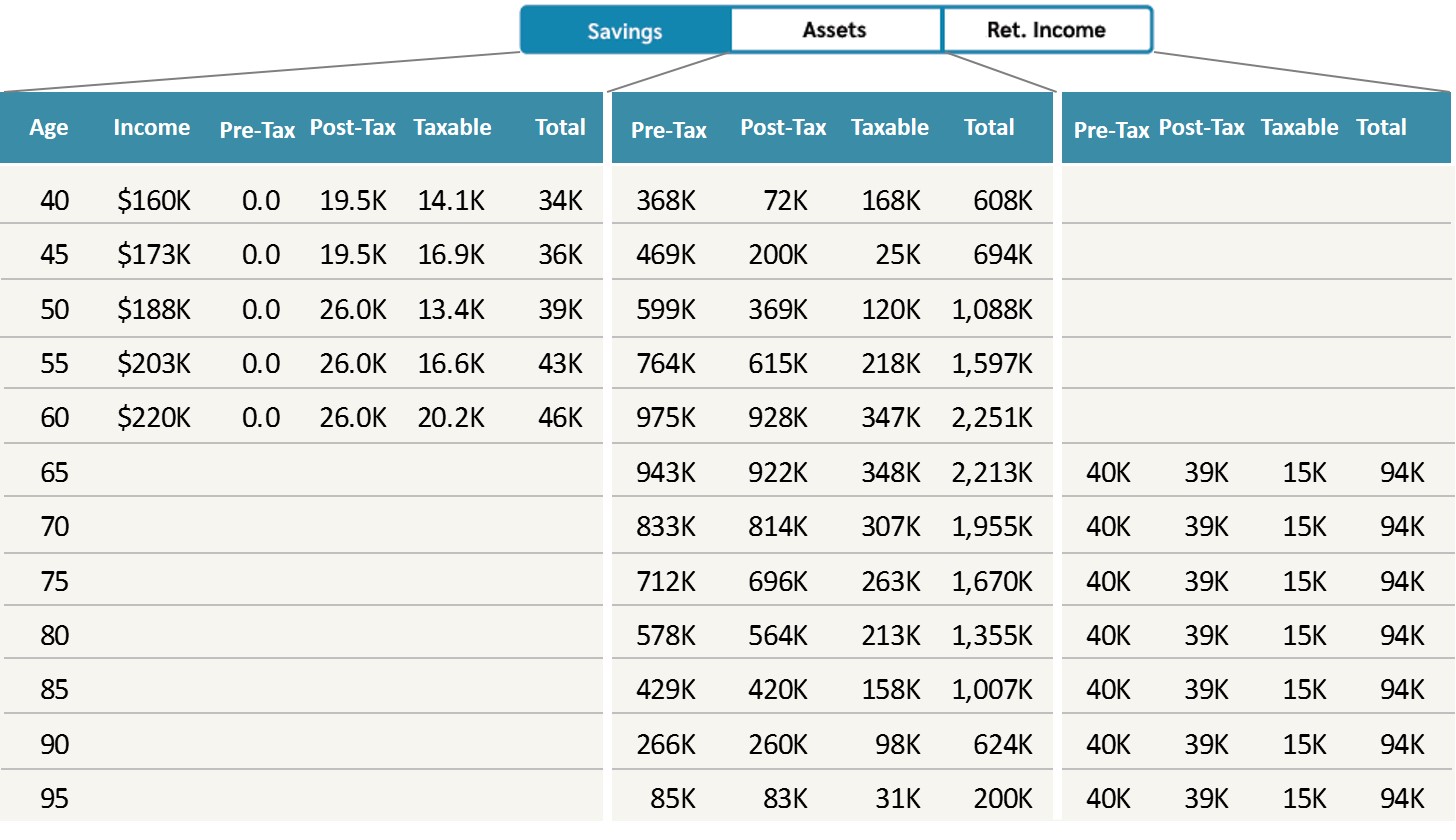

This tool optimizes how much of your retirement savings needs to go into Pre-Tax buckets in order to maximize tax-free income. It then calculates the maximum retirement income that will sustain your nest egg through your life expectancy, while leaving behind only the specified legacy amount. It reports how much of your retirement income will be tax-free. A detailed breakdown of assets by tax buckets at critical junctures in your life are also tabled out.

With this calculator, we are now ready to model a tax-free retirement scenario. Let us take, as an example, a 40-year old individual who makes $160K annually and expects her income to double by the time she retires in her early 60s. Her savings rate is a healthy 21%, and her current investment choices are between moderate to aggressive, but will turn conservative in her retirement. Most of her current assets are in a 401k type account. She is planning to buy a home in 5 years by saving up to $250K towards a down payment. Living a healthy lifestyle, she expects to surpass the average life expectancy for a female in the U.S. She prefers to leave behind a modest legacy of $200K at age 95.

Asset Allocation @Working: Let us run the model in real terms and analyze the output. The tool determines that she already has significant assets in Pre-Tax and hence allocates 100% of future retirement savings to Post-Tax while she is working. Pre-Tax and Post-Tax buckets, being tax-advantaged accounts, grow tax deferred. The growth from the savings in Taxable accounts (e.g., banks, brokerage) are assumed to be a realized gain or interest/dividend received and hence taxed every year in this model. Taxable accounts are used for making the down payment at age 45. This individual has built up a nest egg of $2.4M (her Financial Capital) from a lifetime earning of $4.2M (her Human Capital), all in real terms, by the time she chooses to retire at age 62.

Asset Allocation @Retirement: The tool calculates her maximum retirement income as $94K, adjusted for inflation, for the 33-year retirement period. In this scenario, the individual was able to replenish 42% of her pre-retirement income for the rest of her life. 70% of her retirement income is tax-free. The reason not all her retirement income is tax-free is because of the excessive concentration of her initial assets in Pre-Tax accounts. However, this can be rectified by moving some of the Pre-Tax assets to Post-Tax using Roth Conversion. More on this and other methods used to achieve an optimal asset allocation by retirement is described in “How to Move Asset Between Tax Buckets.” The ideal Pre-Tax asset for this scenario would be $448K* in nominal terms at the time of retirement, whereas this individual had more than twice that amount in Pre-Tax.

Working professionals starting with little or no Pre-Tax assets should only allocate 15-20% of their 401k contribution limit to Pre-Tax accounts like a 401k. The rest of the retirement savings should go to Post-Tax accounts like Roth IRA. However, if your employer match, which is made to Pre-Tax, is already at 15-20%, then make all your contributions to Post-Tax. This strategy would allow you to optimize your savings buckets to achieve a near 0% tax in retirement. A detailed discussion of this approach is presented in “A Framework for a Tax-Free Retirement.”

A video presentation of this blog is available at “How to Use FinCrafters Tax Free Retirement Calculator.”

* Note: To get the ideal Pre-Tax future account value at retirement, run the model in nominal terms and with zero initial Pre-Tax assets.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com