Using the criteria banks use to qualify for a mortgage, we show the income levels required to purchase a townhome, single family and duplex in high priced real estate markets.

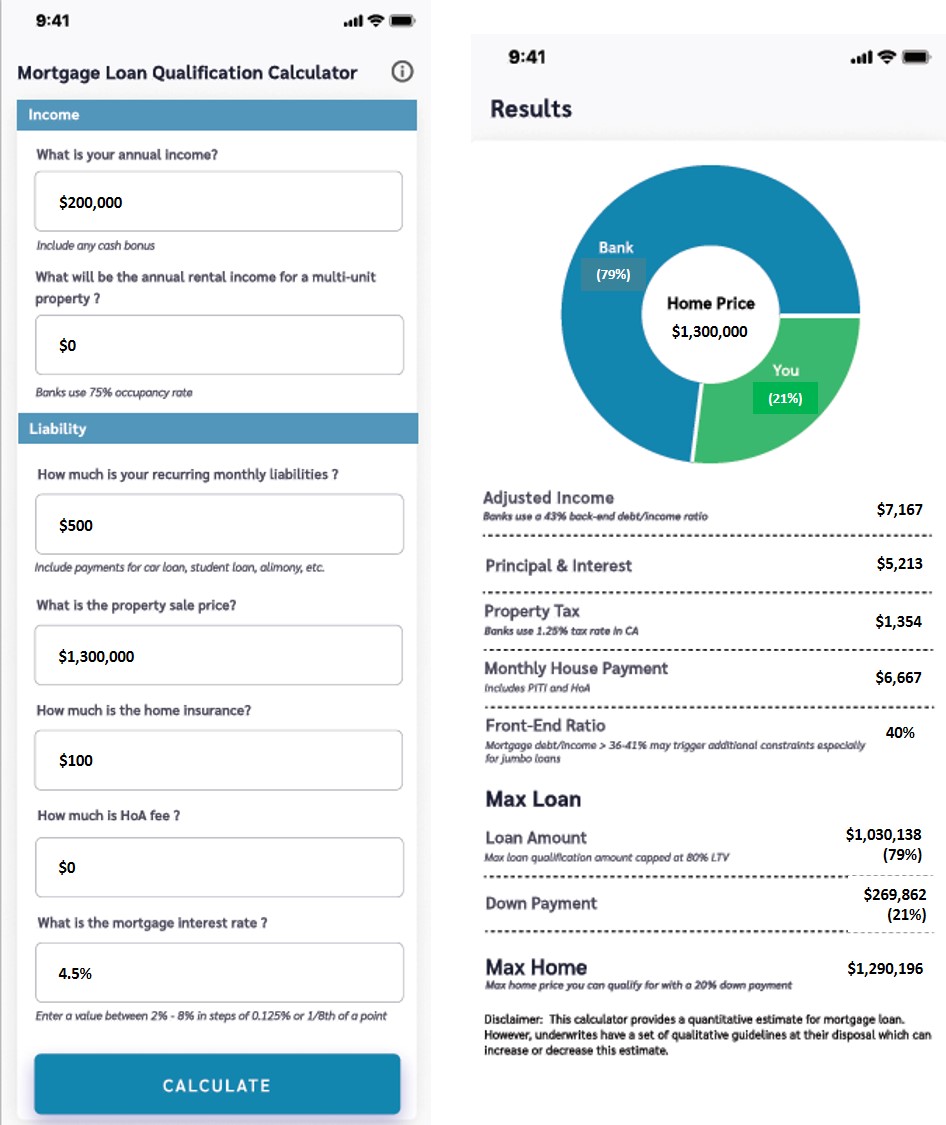

We will use the Mortgage Loan Qualification Calculator from FinCrafters to understand the criteria banks use to qualify borrowers for different types of home buys such as a Townhome, Single Family or a Duplex home. This tool calculates the maximum loan amount for a specific home buy as well as the largest home purchase you could qualify for based on your income and monthly liabilities. Our blog “How Much Of A Mortgage Loan Can You Qualify For?” provides a more detailed analysis of mortgage qualification criteria.

Let us first look at a $1.3M single family home purchase by an individual who makes $200K in annual income, has $500 in car payments and no other liabilities. His income would be adjusted down to $7,167 per month using a 43% back-end ratio that banks use. The property tax rate used is 1.25% for the California market. The tool calculates that he will qualify for a 30-year fixed mortgage with a 4.5% interest rate at 79% of the property value. Hence, the down payment he needs to make is $270K or 21%.

Alternatively, the tool also calculates the maximum home price (in Max Home) for which he could qualify for an 80% loan amount.

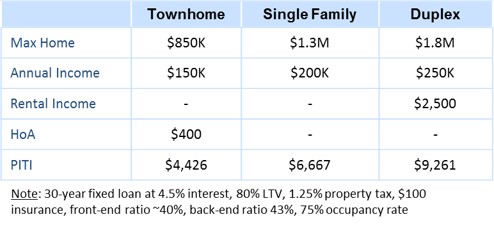

Next let us see how a single family home purchase compares to a $850K townhome. Townhomes usually have a HOA (Home Owners Association) fee, $400 per month for example. Using the same inputs as before, your income must be at least $150K in order to qualify for the full 80% loan.

A duplex home is essentially like buying two joint homes and hence will likely cost more than a single family home in a similar market. However, if one portion is rented out, then you can include 75% of the rent as part of your regular income, which helps you to qualify for a higher loan amount. An individual with a $250K income can qualify for an 80% loan amount to buy a $1.8M duplex with a potential rent of $2,500.

Here, using this calculator, is the mortgage loan qualification summary for the different types of home buys. The analysis focuses on the income level needed to qualify for the maximum LTV (Loan to property Value) of 80%. However, if you qualify for a lower LTV because of a lower income level or higher liabilities relative to the house price, then a higher down payment will be needed to bridge the gap.

Our article “Understanding Mortgage Interest” explains how the principal and interest portions of a mortgage payment are calculated. See “Housing Costs” to understand various closing costs associated with buying and selling real estate. “Comparing Home Buys Using The TCHO Metric” introduces a new TCO metric that normalizes the listed purchase price with dissimilar cost/income elements such as HOA fees, utility charges or a rental income to come up with an effective purchase price.

A video presentation of this blog is available at “How to Use FinCrafters Mortgage Loan Qualification Calculator.”

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com