IRC 7702 is what gives IUL its tax benefits. To qualify, the policy should be designed with a GPT or CVAT, and maintained in a non-MEC status.

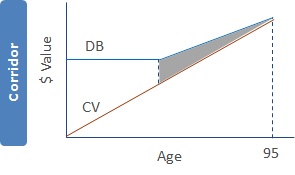

IRC 7702 provides IUL with Roth-like tax benefits. Investment grows tax-deferred and can be withdrawn tax-free. However, IULs are required to carry a life insurance coverage with a Death Benefit (DB) that is at least 1-2.5x the Cash Value (CV). The DB/CV ratio decreases with the age of the insured, reaching 1 at age 95, at which point the CV can be passed on as the DB. Hence, no paid-up insurance coverage is needed after 95.

Corridor stipulates the minimum DB that needs to be carried above the CV. It is governed by the same DB/CV ratio requirement. In a Level DB (Option A) design, as the CV grows, it bumps up the DB to maintain a corridor between the two. This corridor value decreases with age and vanishes when the insured turns 95. Please refer to our blog “Mechanics of IUL” for more information on Option A vs B designs.

Let us now review the two check points used in an IUL design: the Guideline Premium Test (GPT) and the CV Accumulation Test (CVAT). An IUL policy needs to satisfy either the GPT or the CVAT. The insurance carrier’s illustration software performs these checks, but the agent needs to select which test to use.

The GPT is commonly used when the goal is to, 1) maximize CV, and minimize Cost of Insurance (COI) and DB, 2) pay maximum premium beyond 7-pay period. The GPT works by limiting premium relative to DB. The total premium paid has to be less than the Guideline Single Premium (GSP) amount and the total Guideline Level Premium (GLP) payments. The GPT also stipulates that the corridor requirements be always met.

CVAT is preferable when the goal is to make large premiums, such as in a 1035 exchange, over a shorter time period, and where a higher COI is tolerated. CVAT works by limiting CV relative to DB. The CV has to be less than the Net Single Premium (NSP) amount that would have to be paid to fund the future benefits under the contract. Premium amounts such as GSP, GLP, NSP and 7-Pay are calculated by the illustration tool.

In addition to the above test, a 7-Pay Test is also performed to ensure non-MEC status. If an IUL is overfunded, it becomes a Modified Endowment Contract (MEC) and will lose its tax benefits. Hence, it is important to maintain the non-MEC status by limiting the premiums paid to less than the 7-Pay premium amount during the first seven years of the policy. The insurance companies monitor this for in-force policies.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com