Maintaining a $1M home with a $750K mortgage will need about $5K in monthly cash flow and would cost $75K in the buying and selling process.

Here we will explain with examples the cost of buying, maintaining and selling a $1M home. Even though the closing costs and property tax figures are for the San Francisco Bay Area market, the insights apply more broadly.

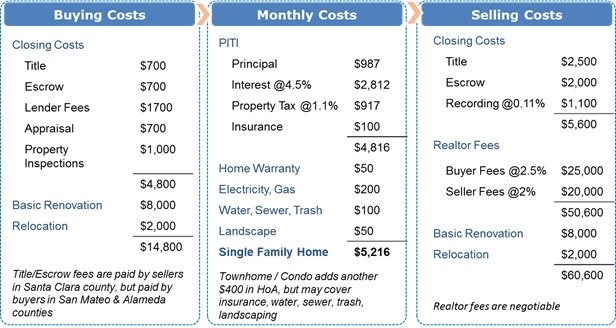

Buying Costs: As a buyer, your closing costs include title, escrow, mortgage loan fees, home appraisal and inspection costs, which adds up to ≈$5K in the example shown. Moving into a new home is usually accompanied with some basic renovation work such as changing the flooring, upgrading the kitchen, etc. and there is also the cost of relocation itself.

Monthly Costs: Once we move into a new home, our monthly bills start. They include the mortgage that pays towards the home principal and accrued interest (see “Understanding Mortgage Interest” for more details). The property taxes and home insurance, though not typically paid monthly, taken together with the mortgage make up PITI (Principal, Interest, Property Tax and Insurance). It may not be a bad idea to carry a home warranty to cover unexpected home repairs, although the coverage details including copayment and exclusions need to be carefully reviewed. Then, there are utility bills, other than the basic electricity and gas that even the renters pay, such as water, sewer, trash and landscaping charges. These additional utility charges and home insurance are often covered by HOA fees in a Condo or a Townhome community. In our example, a monthly cash flow of about $5K is needed to maintain a $1M home with a $750K mortgage.

Selling Costs: As a seller, your closing costs include title, escrow and document recording fees with the county office, which adds up to ≈$5K in our example. Sellers also pay both the buyer and seller’s realtors fees, which tends to be the lion’s share of all costs. The home may need some renovation before it can go on the market for sale. As shown in the example, about $75K can be spent in transaction costs in turning a $1M home.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com