Calculate the maximum home loan you could qualify for based on your income and recurring monthly liabilities.

We will use the Mortgage Loan Qualification Calculator from FinCrafters app to understand the criteria banks use to qualify borrowers for different types of home buys such as a Townhome, Single Family or a Duplex home. This tool calculates the maximum loan amount for a specific home buy as well as the largest home purchase you could qualify for based on your income and monthly liabilities. Our blog “How Much Of A Mortgage Loan Can You Qualify For?” provides a more detailed analysis of mortgage qualification criteria.

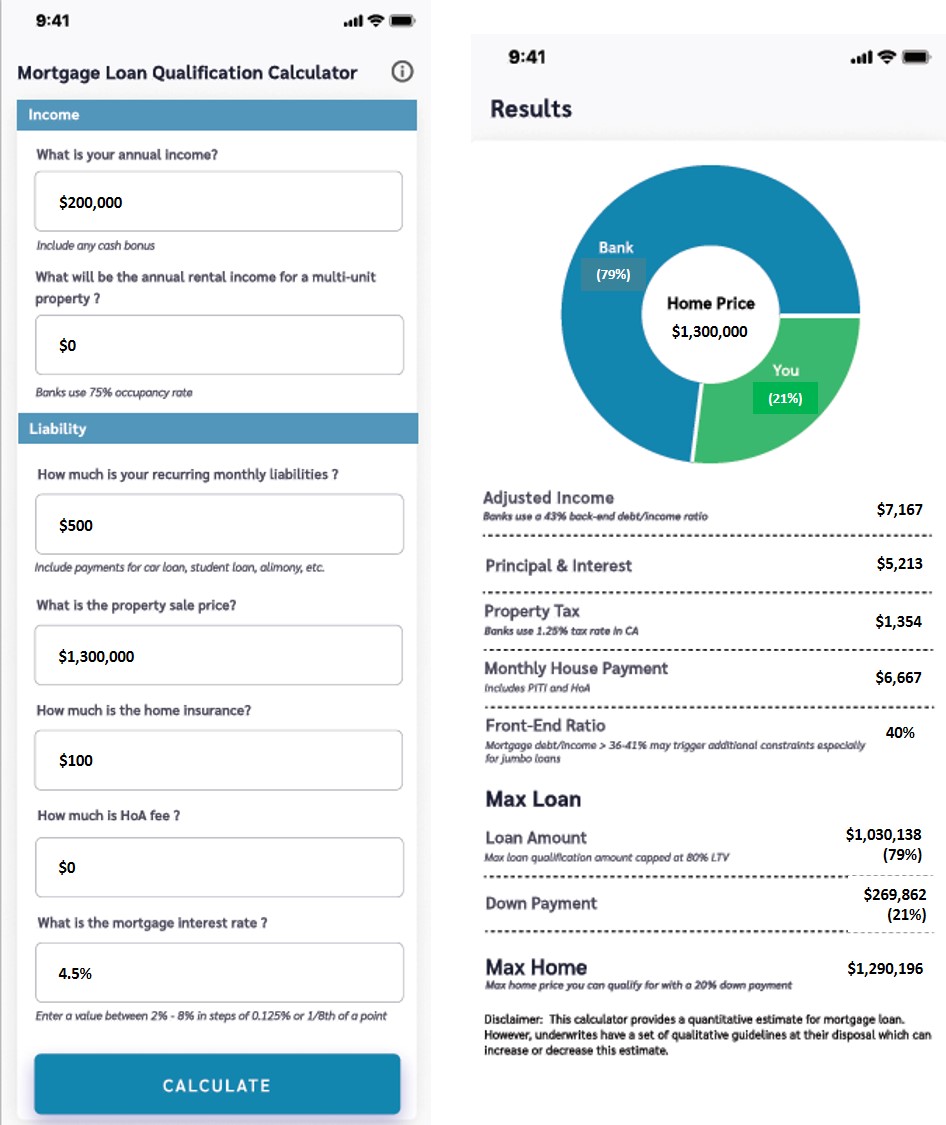

Let us first look at a $1.3M single family home purchase by an individual who makes $200K in income, has $500 in car payments and no other liabilities. Income could include a bonus part provided there is a history of bonus payments in the past. His income would be adjusted down to $7,167 per month using a 43% back-end ratio that banks use. All his monthly liabilities including mortgage cannot exceed this adjusted income. Front-end ratio is the mortgage debt to income ratio. Any value higher than 36-41% may trigger a closer look at the underwriting process, especially for jumbo loans.

When calculating the monthly PITI (Principal, Interest, Taxes and Insurance), a 1.25% rate is used for California property tax and a small amount like $100 for home insurance. Let us assume that the interest rate for a 30-year fixed loan is 4.5%. Based on these parameters, he will qualify for 79% of the property value as the home loan. Hence, the down payment he needs to make is $270K or 21%. The tool caps LTV (Loan to property Value) to 80%.

The tool also calculates the maximum home price (in Max Home) for which he could qualify for an 80% loan amount, which works out to $1.29M, slightly lower than the purchase price of a single family home in our example.

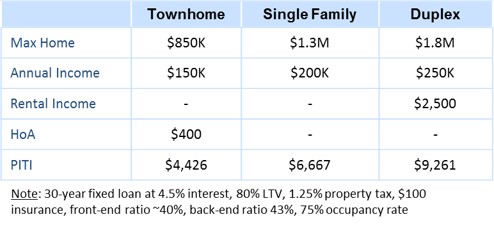

Next let us see how a single family home purchase compares to a $850K townhome. Townhomes usually have a HoA (Home Owners Association) fee, $400 per month for example. Using the same inputs as before, your income must be at least $150K in order to qualify for the full 80% loan.

A duplex home is essentially like buying two joint homes and hence will likely cost more than a single family home in a similar market. However, if one portion is rented out, then you can include 75% of the rent as part of your regular income, which helps you to qualify for a higher loan amount. An individual with a $250K income can qualify for an 80% loan amount to buy a $1.8M duplex with a potential rent of $2,500.

Here, using this calculator, is the mortgage loan qualification summary for the different types of home buys. The analysis focuses on the income level needed to qualify for the maximum LTV of 80%. However, if you qualify for a lower LTV because of a lower income level or higher liabilities relative to the house price, then a higher down payment will be needed to bridge the gap.

Our article “Understanding Mortgage Interest” explains how the principal and interest portions of a mortgage payment are calculated. See “Housing Costs” to understand various closing costs associated with buying and selling real estate. “Comparing Home Buys Using the TCHO Metric” introduces a new TCHO metric that normalizes the listed purchase price with dissimilar cost/income elements such as HOA fees, utility charges or a rental income to come up with an effective purchase price.

A video presentation of this blog is also available on YouTube.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com