IUL / FIA is a conservative alternative to direct investment in the Stock Market. It protects the principal while trading some performance for a much lower volatility.

Investments like Indexed Universal Life (IUL) and Fixed Index Annuity (FIA) use an index crediting method to track their stock market return. Spread, Cap and Participation are the most commonly used strategies. Spread is the number of points deducted off the top of an index return. Cap places a ceiling on the max rate credited from an index return. Participation is the multiplier applied to an index return. The index credit will be 0% for all the index strategies if the market return is negative. This provides principal protection, a hallmark benefit of an IUL and FIA investment.

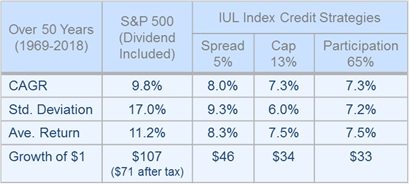

With this understanding of how credit strategies work, let us compare their performance with S&P 500 index over the last 50 years. We will compare four financial metrics: annualized return or CAGR, volatility or standard deviation, average annual return and multiple earned (growth of a dollar over the investment period). Please refer to “Investment Return and Volatility Explained” for an in-depth look at these metrics.

As you can see, the index strategies yield a couple of points in market return in exchange for a much lower volatility. The spread strategy performed the best among the three used in our example. Also, note that the multiple earned in an IUL is tax-free. FIAs are tax-free as well when bought with Roth IRA funds.

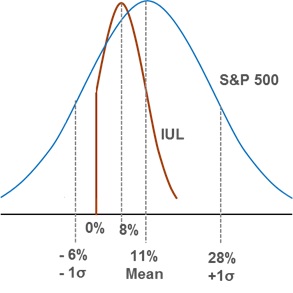

Let us look now at how the distribution of annual returns compares between credit strategies and the S&P 500. For the S&P 500, the range of returns, one standard deviation away from the average annual return, is -6% and +28%. This means that there is a 2/3rd chance that a future annual return will fall within the ±1σ range. This range is much narrower for an IUL/FIA. The low end of the IUL/FIA distribution looks cut off because IUL/FIA returns cannot be negative. The high end of the ±1σ range is 17.6% (average return 8.3% + standard deviation 9.3%). This smaller range is indicative of the lower volatility when compared to that of the market.

How is principal protection achieved?

The bulk of the policy value is invested in long-term bonds. If the bond yield is r%, then only 1/((1+r%) of the policy value needs to be invested in the bonds in order to restore the original principal amount when the bond payment is made. For example, with a 5% bond yield, only about 95% of the policy value is invested in bonds, freeing up the remaining 5% to be invested in option derivatives in the Stock Market, which enables the investment to generate a positive overall return.

Insurance companies set the rates described in the credit strategies based on its stock option portfolio performance. Notwithstanding competitive pressures, these rates do shift around a bit based on market movement. The benefits of IUL investments, such as lower volatility, principal protection and tax-free treatment, are summarized in our blog “IUL Benefits” and an investment example is provided in “How IUL Works.”

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com