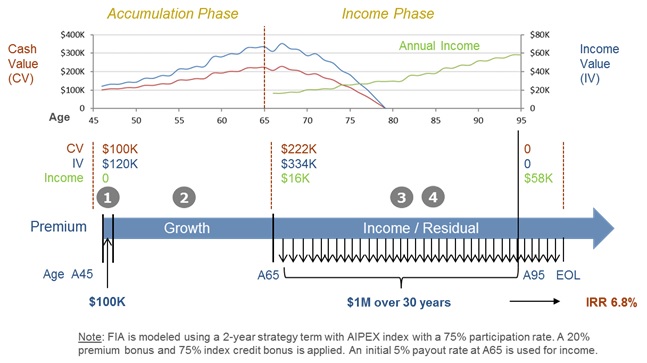

A deferred Fixed Index Annuity (FIA) tracks a market index during the Accumulation Phase, and pays out an annual income during the Income Phase.

FIAs can provide a risk-free inflation-adjusted income stream like Social Security benefits. Let us go through the investment phases which a FIA involves. The initial investment marks the Premium phase. Next is the Growth or Accumulation phase, when this money is allowed to track the growth of a market index subject to a cap or a participation rate (please refer to “How Index Crediting Works” for more details). The principal is also protected from market downturns. The Income Phase begins after this deferral period, where a set payout rate of the account value is paid out as the annuitized income. The income is adjusted upward annually if the market goes up, but will remain the same if the market has negative returns; hence it is market-risk free. In the last phase, the Residual Phase, when the insured passes away, the lifetime income stops and any remaining CV will go to the beneficiaries.

A deferred FIA has two accounts: Cash Value (CV) and Income Value (IV). CV is the money available to the policy owner at any given time. It earns market credit from the selected index strategy. IV is more for internal accounting. IV value is usually higher than CV because it receives bonuses and market credit. The starting income is calculated from the IV balance. Annuitized income is deducted from CV/IV balances. A lifetime income option guarantees that the market-adjusted income continues even after the CV/IV balances drops to zero. A more in-depth discussion of this topic can be found in “Mechanics of an Annuity.”

In our example, a 45-year old male invests $100K as a single premium. The investment tracks the risk-controlled AIPEX index with a 75% participation rate. After 20 years of accumulation, CV available for lumpsum withdrawal is $222K. If, instead, income is started, payout rate at age 65 is 5% of the $334K IV, which works out to $16K during the first year of annuitization. Based on past market performance, this income grows to $58K by age 95. The cumulative income taken over the 30-year period is ≈$1M. The annualized IRR over the 50-year investment period is 6.8%.

Annuities are tax-deferred investments, but when bought within a Roth IRA, income is also tax-free. “Annuity Tax Implications” catalogs the tax consequences when funded from different tax-advantaged accounts. The growth, tax and other benefits of owning an annuity are presented in our blog “Annuity Benefits.”

Not all FIAs are made equal, however. It takes considerable market research and numerical analysis to pick a top-performing FIA. You can find more information about this in “Annuity Policy Design Considerations.”

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com