Uncorrelated asset classes have different boom/bust cycles. Capitalize on these by including them in a portfolio and keeping the portfolio rebalanced.

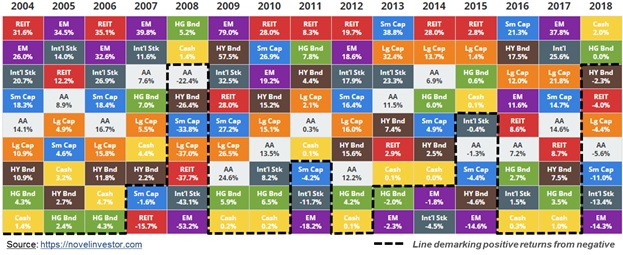

We explained the basics of the many commonly used asset classes in our blog “Types of Asset Classes.” In this blog, we will review how peak performing asset classes cycle through with different boom and bust periods. The chart shows 8 asset classes over a 15-year period. The asset classes are represented by their corresponding market indices. AA is an example portfolio with asset allocation from all 8 asset classes rebalanced annually.

In observing the 15-year performance period, we can see that the REITs had many more peaks and troughs compared to that of the Emerging Markets. This shows that the boom/bust period varies with the asset class. The dotted line separates positive returns from negative returns. During the 2008 housing recession, the most conservative asset classes came out on top. During the subsequent market recovery period, the more aggressive asset classes provided the best returns.

During this 15-year period, the Emerging Markets and REITs performed the best with the highest CAGR (annualized return); however, they were also the most volatile. The example portfolio AA had a middle-of-the-road performance, but the annual returns were also much less volatile. Rebalancing allows you to capture some of the gains from appreciated asset classes (sell high) and invest it in depressed asset classes (buy low). Thus, rebalancing capitalizes on the cyclic nature of these asset classes. Please read our blog “Portfolio Construction and Rebalancing” to learn more about building and maintaining a well-diversified portfolio.

We specialize in tax-free retirement strategy and investments such as IUL, Annuity and LTC. Prefer a quick and complimentary consultation? Just email us at Karthik@FinCrafters.com